TL;DR Business transactions consume hours of valuable work time daily. Manual processing creates bottlenecks that slow revenue collection. Human errors in data entry cost companies thousands in corrections. Your team deserves better tools for handling routine transactions.

Table of Contents

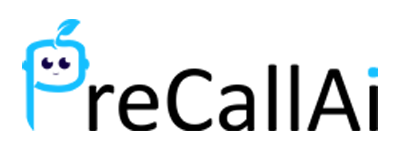

SaaS AI transaction bots for businesses revolutionize how companies handle purchases. These intelligent systems automate everything from quotes to payment processing. Your staff focuses on strategic work instead of repetitive tasks. Customers enjoy faster, more accurate transaction experiences throughout.

Modern AI bots eliminate friction at every stage of transactions. They understand natural language and respond intelligently to customer needs. Integration with existing systems happens seamlessly without major disruptions. This guide explores how these powerful tools transform business operations.

Understanding SaaS AI Transaction Bots

What Makes These Bots Different

Traditional automation follows rigid, predefined rules that limit flexibility. Basic chatbots recognize only specific commands programmed into systems. They fail when customers phrase requests differently than expected. Frustration builds as users repeat themselves without getting help.

SaaS AI transaction bots for businesses use machine learning capabilities. They understand context and intent behind customer messages accurately. Natural language processing interprets variations in how people communicate. The bots learn from every interaction to improve responses.

Cloud-based delivery eliminates complex installation and maintenance requirements completely. Your team accesses bots through simple web interfaces instantly. Updates happen automatically without downtime or manual intervention needed. Scalability adjusts to transaction volume fluctuations effortlessly throughout time.

Core Components of Transaction Bots

Conversational interfaces make interactions feel natural and intuitive always. Customers type or speak requests in everyday language comfortably. The bot interprets meaning rather than matching exact keywords. Dialogue flows logically toward transaction completion without confusion.

Payment processing integration connects securely to major financial gateways. Stripe, PayPal, and Square work seamlessly with leading bots. PCI compliance standards protect sensitive customer financial information thoroughly. Tokenization keeps credit card details secure from potential breaches.

Business system connectivity synchronizes data across your entire technology stack. CRM platforms receive transaction details automatically after completion. Inventory systems update in real-time as purchases finalize. Accounting software records revenue without manual entry required ever.

Intelligence layers analyze transaction patterns and customer behavior continuously. Machine learning identifies opportunities for upselling or cross-selling naturally. Anomaly detection flags potentially fraudulent transactions before processing completes. Predictive analytics forecast transaction volumes for better resource planning.

Why Businesses Choose SaaS Solutions

Capital expenditure requirements disappear with SaaS subscription models completely. You pay predictable monthly fees instead of large upfront costs. No hardware purchases or server infrastructure investments become necessary. Budget planning becomes simpler with consistent operational expenses monthly.

Technical expertise requirements drop dramatically compared to traditional software. Your team manages bots through intuitive dashboards without coding knowledge. The vendor handles all backend maintenance, security, and updates. Internal IT resources focus on strategic projects instead of maintenance.

When you deploy SaaS AI transaction bots for businesses, speed matters greatly. Setup takes days or weeks instead of months of implementation. Pre-built integrations connect to popular business tools immediately. Templates provide starting points that you customize for specific needs.

Continuous improvement comes standard with SaaS platforms automatically always. Vendors add new features regularly based on market demands. AI models improve with expanded training data from all users. Your bots become more capable over time without extra work.

Key Benefits of AI Transaction Bots

Speed and Efficiency Gains

Manual transaction processing involves numerous time-consuming steps that compound. Staff members retrieve customer information from multiple systems separately. They calculate pricing, apply discounts, and generate quotes individually. Payment collection requires sending invoices and following up repeatedly.

Automated bots complete entire transactions in seconds rather than hours. Customer requests trigger instant retrieval of relevant account information. Pricing calculations happen automatically based on predefined business rules. Payment processing occurs within the same conversation without delays.

Your team handles five times more transactions with bot assistance. Staff productivity increases as repetitive work disappears from daily routines. High-value activities like relationship building receive more attention deserved. Customer satisfaction improves with faster response times across interactions.

Transaction cycle times shrink from days to minutes consistently. Quotes arrive instantly instead of requiring 24-hour turnarounds. Payment confirmations appear immediately after successful transaction completion. Order fulfillment begins faster with automated processing triggering workflows.

Accuracy and Error Reduction

Human data entry introduces errors in approximately 1% of transactions. Typos in customer names create database duplicates and confusion. Incorrect pricing leads to revenue leakage or customer disputes. Payment amount mistakes require time-consuming reconciliation and corrections.

SaaS AI transaction bots for businesses eliminate manual entry mistakes entirely. Systems pull data directly from integrated sources without retyping. Calculations follow programmed logic that produces consistent results always. Validation rules catch potential errors before transactions finalize.

Compliance adherence improves dramatically with automated verification processes built-in. Tax calculations apply correct rates based on customer locations. Discount rules enforce business policies without exception or favoritism. Regulatory requirements get checked automatically during every transaction.

Data quality across systems improves with synchronized information flows. Customer details remain consistent in CRM, accounting, and inventory systems. Transaction history provides complete audit trails for compliance reporting. Reporting accuracy increases when data conflicts and duplicates disappear.

Cost Reduction Opportunities

Labor costs decrease as automation handles routine transaction processing. One bot performs work that previously required multiple staff members. Overtime expenses drop when bots handle after-hours transaction requests. Your team size stays stable even as transaction volumes grow.

Training expenses fall when onboarding focuses on strategic rather than tactical skills. New employees need less time learning transaction processing procedures. Reduced turnover results from more engaging, less repetitive work. Knowledge retention improves when bots handle routine tasks.

Infrastructure costs remain low with cloud-based SaaS delivery models. No expensive servers or data center space becomes necessary. Software licensing costs stay predictable with subscription-based pricing. Maintenance and upgrade expenses vanish with vendor-managed platforms.

Error correction costs disappear as accuracy improvements eliminate mistakes. Fewer refunds and chargebacks result from correct transaction processing. Customer service tickets decline when transactions complete smoothly initially. Reconciliation time decreases with accurate, synchronized transaction data.

Scalability Without Growing Pains

Traditional transaction processing requires hiring more staff for volume increases. Recruitment, training, and onboarding consume months of preparation time. Seasonal spikes create staffing challenges and increased labor costs. Scaling down after busy periods creates uncomfortable workforce reductions.

SaaS AI transaction bots for businesses scale instantly to meet demand. Handle ten transactions or ten thousand with identical efficiency. Peak periods like holidays pose no resource constraints. Your costs scale proportionally with usage rather than requiring overprovisioning.

Geographic expansion happens seamlessly without location-specific infrastructure investments needed. Bots serve customers globally from centralized cloud infrastructure. Multiple languages and currencies work without separate implementations. Time zone differences become irrelevant with 24/7 automated availability.

New product launches or service offerings integrate quickly into existing bots. Add transaction types without rebuilding entire systems from scratch. Test new offerings with small customer groups before full rollout. Iterate rapidly based on real transaction data and feedback.

Essential Features for Transaction Automation

Natural Language Understanding

Sophisticated language models interpret customer intent from conversational messages accurately. People phrase requests differently based on personal communication styles. The bot recognizes that “I want to buy” and “looking to purchase” mean the same thing. Context from previous messages informs interpretation of ambiguous statements.

Multi-turn conversations maintain context across multiple message exchanges seamlessly. Customers provide information gradually rather than all at once. The bot remembers details shared earlier in the conversation. Clarifying questions feel natural rather than forcing users to start over.

When you implement SaaS AI transaction bots for businesses, language support expands reach significantly. Global customers transact in their native languages comfortably. Translation happens automatically without separate bot versions per language. Cultural nuances in communication get recognized and respected appropriately.

Sentiment analysis detects customer emotions during transaction interactions effectively. Frustrated customers trigger escalation to human agents proactively. Excited customers might receive upgrade offers or premium suggestions. Confused customers get additional explanation and guidance automatically.

Payment Processing Capabilities

Multiple payment method support accommodates diverse customer preferences globally. Credit and debit cards remain the most common options. Digital wallets like Apple Pay and Google Pay grow rapidly. Bank transfers serve B2B transactions with larger amounts involved.

Recurring billing automation handles subscription-based revenue models efficiently. Initial setup captures payment information for future automated charges. Retry logic attempts failed payments with smart timing strategies. Dunning management prevents involuntary churn from expired payment methods.

Split payment options enable complex transaction scenarios for customers. Deposits collect partial payment upfront for service bookings. Installment plans divide purchases into manageable smaller payments. Group payments split costs among multiple people automatically.

Refund and cancellation processing happens through the same bot interface. Customers request refunds conversationally without submitting formal tickets. Policy rules determine automatic approval or human review requirements. Money returns to original payment methods within days.

Security and Compliance Standards

End-to-end encryption protects transaction data throughout the entire process. Information remains encrypted in transit and at rest. Only authorized systems decrypt data when absolutely necessary. Security keys rotate regularly to minimize breach exposure risks.

PCI DSS compliance ensures proper handling of payment card information. Bots never store raw credit card numbers in databases. Tokenization replaces sensitive data with meaningless reference codes. Regular security audits verify ongoing compliance maintenance efforts.

SaaS AI transaction bots for businesses meet various industry regulations. GDPR compliance protects European customer data privacy rights. CCPA addresses California consumer data protection requirements. HIPAA standards apply when handling healthcare-related transaction information.

Two-factor authentication adds extra security layers for high-value transactions. SMS codes verify customer identity before processing large purchases. Biometric options like fingerprints provide seamless security on mobile devices. Risk-based authentication applies stricter requirements to suspicious transactions only.

Analytics and Reporting Tools

Real-time dashboards display transaction metrics and key performance indicators. Monitor transaction volumes throughout the day for capacity planning. Track successful completion rates to identify process improvement opportunities. Revenue visibility helps with accurate forecasting and goal tracking.

Customer behavior insights reveal patterns in transaction preferences and timing. Peak transaction periods inform staffing and system resource allocation. Product popularity data guides inventory and marketing decisions. Drop-off analysis shows where customers abandon transaction processes.

Financial reporting integrates transaction data with accounting systems automatically. Daily revenue summaries replace manual calculation and consolidation work. Tax reports compile necessary information for compliance filing requirements. Commission calculations for sales teams happen accurately and automatically.

Performance benchmarking compares your metrics against industry standards. Understand how your transaction processes stack up against competitors. Identify specific areas where improvements yield the greatest returns. Track progress over time toward operational excellence goals.

Implementation Strategies for Transaction Bots

Assessing Your Transaction Workflows

Document every step in current transaction processes from start to finish. Map customer touchpoints throughout the entire transaction journey. Identify pain points where delays or errors occur most frequently. Quantify time spent on each activity for baseline measurements.

Stakeholder interviews reveal different perspectives on transaction challenges faced. Sales teams describe customer objections and common questions encountered. Finance staff highlight reconciliation difficulties and error correction efforts. Customer service representatives share complaint themes and resolution patterns.

When you plan SaaS AI transaction bots for businesses, prioritization drives success. Rank transaction types by volume to maximize automation impact. Identify highest-value transactions where accuracy matters most critically. Consider customer satisfaction impact when selecting automation candidates initially.

Technical requirements assessment ensures compatibility with existing systems thoroughly. Catalog all applications involved in transaction processing currently. Document APIs available for integration with external systems. Identify data formats and protocols required for seamless connectivity.

Selecting the Right Bot Platform

Feature comparison matrices help evaluate multiple vendors objectively against requirements. Rate each platform on critical capabilities like language understanding. Score integration options with your essential business applications. Consider ease of use for non-technical team members.

Proof of concept projects test real-world performance before full commitment. Build sample transaction flows using actual business scenarios. Process test transactions through complete cycles to verify functionality. Gather feedback from team members who will use the system.

Vendor evaluation extends beyond just technology capabilities alone. Research company stability and long-term viability in the market. Review customer references from similar industries and use cases. Assess support quality through pre-sales interactions and documentation reviews.

Pricing analysis considers total cost of ownership beyond subscription fees. Calculate implementation costs including integration and customization work. Factor in training expenses for staff learning new systems. Project ongoing costs for additional users or transaction volume growth.

Integration with Existing Systems

API connectivity forms the foundation for seamless data exchange. RESTful APIs work with most modern business applications easily. Webhook capabilities enable real-time event notifications between systems. Bulk data synchronization keeps large datasets consistent across platforms.

Pre-built connectors accelerate integration with popular business software tremendously. CRM integrations with Salesforce, HubSpot, and others work immediately. E-commerce platforms like Shopify and WooCommerce connect seamlessly. Accounting system links to QuickBooks and Xero reduce manual bookkeeping.

SaaS AI transaction bots for businesses require careful data mapping planning. Match fields between bot and business system data structures. Define transformation rules when data formats differ between platforms. Establish synchronization schedules for batch data updates appropriately.

Testing protocols verify integration reliability under various scenarios comprehensively. Confirm successful data flow in both directions between systems. Test error handling when connectivity issues arise temporarily. Validate data accuracy through sample transaction comparisons manually.

Training and Change Management

User training programs prepare teams for new transaction workflows effectively. Hands-on workshops let staff practice with the bot in safe environments. Video tutorials provide reference materials for complex procedures. Quick reference guides offer at-a-glance reminders of common tasks.

Change champions within each department advocate for bot adoption enthusiastically. Early adopters demonstrate benefits to skeptical colleagues through examples. Success stories highlight time savings and reduced frustration levels. Peer support networks help people troubleshoot issues collaboratively.

Gradual rollout minimizes disruption while building confidence in new systems. Start with one transaction type before expanding to others. Pilot with a small user group before company-wide deployment. Gather feedback and make adjustments before broader implementation phases.

Communication plans keep everyone informed throughout the implementation journey. Regular updates share progress milestones and upcoming changes. FAQ documents address common questions and concerns proactively. Feedback channels let users voice suggestions for improvements openly.

Use Cases Across Different Industries

E-Commerce and Retail Transactions

Product browsing assistance helps customers find exactly what they need quickly. Conversational search understands descriptive queries beyond exact product names. Size and color availability checks happen instantly during conversations. Personalized recommendations suggest items based on browsing history patterns.

Shopping cart management through natural conversation simplifies the purchase process. Customers add items by simply stating what they want. Quantity adjustments happen through simple commands without navigation clicking. The cart review summarizes selections before moving to payment completion.

When you deploy SaaS AI transaction bots for businesses in retail, upselling improves revenue. Bots suggest complementary products based on cart contents intelligently. Bundle offers appear automatically for frequently purchased combinations. Limited-time promotions create urgency without being pushy or annoying.

Order tracking information arrives proactively without customers needing to ask. Shipping updates get pushed as packages progress through delivery networks. Delivery delays trigger automatic notifications with revised estimates provided. Returns and exchanges are processed through simple conversational requests easily.

Financial Services Transactions

Account opening processes that traditionally take days complete in minutes. Customer information collection happens through guided conversational flows naturally. Document uploads occur within the chat interface without separate portals. Identity verification uses automated checks reducing manual review requirements.

Fund transfers between accounts happen through simple text commands. Customers specify amounts and destination accounts conversationally clearly. Security verification ensures authorized users initiate all transactions properly. Confirmation messages provide transaction details and reference numbers immediately.

Loan applications process faster with automated information gathering and analysis. Customers answer qualification questions in natural conversation formats. Credit checks happen automatically in the background during conversations. Approval decisions arrive within minutes instead of days of waiting.

Investment transactions enable customers to buy and sell securities conversationally. Real-time pricing information displays before trade execution occurs. Risk warnings appear automatically for complex or volatile investments. Transaction confirmations include all regulatory disclosures required by law.

Healthcare Appointment and Billing

Appointment scheduling through SaaS AI transaction bots for businesses reduces administrative burden significantly. Patients describe preferred dates and times in their own words. The bot checks provider availability across multiple locations automatically. Confirmation messages include all appointment details and preparation instructions.

Insurance verification happens automatically during the booking process seamlessly. Patient information triggers real-time eligibility checks with insurance providers. Coverage details inform patients of expected out-of-pocket costs upfront. Pre-authorization requirements get flagged before appointments when necessary.

Payment collection for copays and deductibles occurs before appointments begin. Automated reminders include payment links sent via text messages. Patients complete payment within seconds using stored payment methods. Receipts arrive immediately for insurance submission or record-keeping purposes.

Billing questions get answered instantly through conversational interactions always. Patients ask about specific charges in natural language easily. The bot explains codes and services in understandable terms. Payment plans get arranged automatically based on predefined qualification rules.

B2B Sales and Procurement

Quote generation for complex B2B transactions happens in real-time during conversations. Sales bots access pricing databases including volume discounts and contracts. Custom configurations get priced accurately based on specific requirements. Approval workflows route quotes exceeding authority limits to managers.

Purchase order processing automates buyer workflows from requisition through payment. Conversational interfaces let employees request items describing needs naturally. Approval chains route requests based on amount and category rules. Vendor notifications trigger fulfillment processes immediately upon approval confirmation.

SaaS AI transaction bots for businesses streamline vendor invoice processing substantially. Invoices submitted to bots get matched against purchase orders automatically. Three-way matching verifies quantities and prices before payment approval. Exception handling routes discrepancies to appropriate personnel for resolution.

Contract renewals process automatically as expiration dates approach steadily. Bots notify stakeholders well in advance of renewal deadlines. Updated terms get presented for review and approval electronically. Payment processing happens seamlessly for approved renewals without manual intervention.

Optimizing Bot Performance Over Time

Continuous Training and Improvement

Conversation analysis identifies common customer requests not handled optimally currently. Review transcripts regularly to find patterns in user frustration. Document new question types that emerge as business evolves. Prioritize improvements based on frequency and business impact assessment.

Machine learning model retraining incorporates new data for accuracy improvements. Additional conversation examples help bots understand variations better. New product information updates bot knowledge bases regularly. Seasonal terminology gets added before peak periods arrive.

A/B testing compares different conversational approaches for effectiveness measurement. Test various response phrasings to find most effective language. Compare linear versus branching conversation flows for conversion rates. Experiment with when to offer human handoff options appropriately.

User feedback collection provides qualitative insights about bot experiences directly. Post-transaction surveys ask about satisfaction with bot interactions. Thumbs up/down ratings identify specific messages needing improvement. Open-ended comments reveal unexpected issues or opportunities for enhancement.

Monitoring Key Metrics

Completion rate tracks percentage of transactions successfully finished through bots. High completion indicates effective conversation design and functionality. Declining rates signal potential issues requiring immediate investigation and attention. Segment by transaction type to identify specific problem areas.

Average handling time measures efficiency of bot-assisted transaction processes. Compare bot times against previous manual processing benchmarks. Track trends over time as bot learning improves performance. Unusually long durations suggest confusion or technical problems occurring.

When measuring SaaS AI transaction bots for businesses, accuracy matters tremendously. Transaction error rates show how often mistakes occur in processing. Financial accuracy ensures correct amounts and account assignments always. Data quality metrics measure completeness and consistency of captured information.

Customer satisfaction scores reflect overall experience quality with bot interactions. Compare bot scores against human agent satisfaction levels. Track improvements following bot enhancements and updates implemented. Investigate sharp drops that might indicate new issues introduced.

Scaling Bot Capabilities

New transaction types get added as bots prove value in initial deployments. Start with simple, high-volume transactions for quick wins. Expand to complex scenarios once confidence builds in bot capabilities. Eventually cover the entire transaction portfolio for maximum efficiency gains.

Channel expansion brings bot capabilities to additional customer touchpoints progressively. Start with website chat as the primary bot interface. Add messaging apps like WhatsApp and Facebook Messenger subsequently. Integrate with voice channels for phone-based transactions eventually.

Geographic expansion requires localization beyond simple language translation alone. Cultural differences affect conversation styles and expectations significantly. Local payment methods need integration in different regional markets. Regulatory compliance varies by country and must be addressed.

Advanced features emerge as AI technology continues evolving rapidly. Predictive capabilities anticipate customer needs before explicit requests occur. Emotional intelligence enables more empathetic responses to customer situations. Proactive outreach initiates transactions based on behavioral triggers identified.

Overcoming Common Implementation Challenges

Integration Complexity Issues

Legacy system connectivity poses the biggest technical challenge often. Older applications lack modern APIs for easy integration. Custom development work becomes necessary for data exchange. Middleware platforms help bridge gaps between old and new systems.

Data inconsistency across systems creates confusion during bot interactions. Customer records exist in multiple places with conflicting information. Address cleansing and deduplication projects improve data quality. Master data management establishes single sources of truth organization-wide.

Real-time synchronization requirements strain some backend systems significantly. High transaction volumes create database performance bottlenecks potentially. Caching strategies reduce load on core business systems. Asynchronous processing handles non-critical updates without blocking transactions.

Security requirements restrict system access for integration purposes understandably. Obtain necessary approvals from security teams early in planning. Implement proper authentication and authorization for bot system access. Regular security audits ensure ongoing compliance with policies.

User Adoption Resistance

Change fatigue affects organizations that have experienced multiple system changes. Staff members resist learning yet another new tool or process. Emphasize simplicity and actual time savings in communications clearly. Demonstrate real examples from pilot programs to build credibility.

Trust concerns arise when people worry about AI replacing jobs. Communicate clearly that bots handle tasks, not eliminate positions. Explain how automation frees people for more valuable work. Involve staff in implementation to give them ownership stakes.

Technical comfort varies widely across user populations in organizations. Some people embrace new technology enthusiastically while others struggle. Provide multiple training formats accommodating different learning styles effectively. Offer ongoing support during early adoption phases generously.

When implementing SaaS AI transaction bots for businesses, patience proves essential. Adoption takes longer than purely technical implementations typically. Celebrate small wins and early adopters publicly to build momentum. Address concerns and feedback seriously to demonstrate commitment to success.

Maintaining Bot Accuracy

Language evolution means bots require ongoing updates to stay current. New slang and terminology emerge constantly in popular usage. Industry jargon changes as technologies and practices evolve. Regional variations create different expressions for identical concepts.

Edge cases represent unusual scenarios not covered in initial training. Rare transaction types get overlooked during initial bot development. Exceptional circumstances create unexpected conversation flows that confuse bots. Comprehensive testing catches many issues but not everything possible.

Data quality degradation occurs gradually as source systems accumulate errors. Outdated product catalogs show unavailable items to customers. Pricing information falls out of sync with actual current rates. Regular audits identify and correct data quality issues proactively.

Feedback loops ensure continuous improvement addresses emerging issues quickly. Monitor bot conversations for signs of customer confusion regularly. Track escalation patterns to identify knowledge gaps systematically. Prioritize updates based on frequency and severity of problems.

Security Best Practices for Transaction Bots

Data Protection Measures

Encryption standards protect transaction data throughout entire processing lifecycles. TLS secures data in transit between customers and bot systems. AES-256 encryption protects data at rest in storage systems. Regular key rotation minimizes risk from potential key compromises.

Access controls limit who can view or modify transaction data. Role-based permissions assign minimum necessary access levels only. Multi-factor authentication protects administrative access to bot systems. Audit logs track all access for compliance and security monitoring.

SaaS AI transaction bots for businesses implement data retention policies carefully. Store transaction records only as long as legally required. Automated deletion removes old data according to retention schedules. Anonymization protects customer privacy in retained analytics data.

Backup systems ensure business continuity if primary systems fail. Regular automated backups capture all critical transaction data. Geographic redundancy protects against regional outages or disasters. Recovery time objectives guide backup frequency and restoration procedures.

Fraud Prevention Techniques

Behavioral analytics detect unusual patterns indicating potential fraud attempts. Velocity checks limit transaction frequency from single accounts. Amount anomalies flag purchases significantly different from typical behavior. Geographic inconsistencies identify suspicious location changes between transactions.

Device fingerprinting recognizes returning customers and identifies suspicious devices. Known good devices streamline authentication for legitimate customers. New or suspicious devices trigger additional verification requirements. Stolen device detection prevents fraud from compromised customer phones.

Machine learning models identify sophisticated fraud patterns humans might miss. Training data includes known fraud cases from across industries. Models adapt to evolving fraud techniques automatically over time. False positive rates stay low to avoid frustrating legitimate customers.

Human review processes handle edge cases requiring judgment calls. Suspicious transactions queue for manual investigation before processing. Fraud specialists evaluate risk based on multiple data points. Clear escalation procedures ensure rapid response to confirmed fraud.

Compliance Monitoring Systems

Automated compliance checks verify adherence to regulations during transactions. Tax calculation engines apply correct rates based on jurisdiction rules. Age verification ensures restricted products reach only qualified buyers. Export controls prevent prohibited international sales automatically.

Audit trail completeness provides transparency for regulatory examinations always. Every transaction records who, what, when, and why details. Immutable logs prevent tampering with historical transaction records. Search capabilities let auditors find specific transactions quickly.

Regulatory reporting automation generates required filings and submissions automatically. Transaction data aggregates according to reporting format specifications. Scheduled reports submit to regulatory agencies on required deadlines. Exception reports highlight transactions requiring special attention or disclosure.

SaaS AI transaction bots for businesses must adapt to regulatory changes. Vendors monitor regulatory developments across all jurisdictions served. Updates implement new compliance requirements before effective dates. Customers receive notifications about changes affecting their operations.

Future of Transaction Automation

Emerging AI Capabilities

Predictive transaction initiation anticipates customer needs before explicit requests. Purchase history analysis identifies replenishment timing for consumables. Behavioral patterns suggest upsell opportunities at optimal moments. Proactive outreach feels helpful rather than intrusive or annoying.

Emotional AI detects and responds to customer sentiment during transactions. Voice tone analysis identifies frustration or confusion in real-time. Response adjustments match emotional context of customer situations. Empathetic interactions build stronger customer relationships through understanding.

Multi-modal interactions combine text, voice, and visual elements seamlessly. Customers switch between typing and speaking mid-conversation naturally. Image recognition identifies products customers photograph for purchase. Video calls escalate complex transactions requiring visual guidance.

Autonomous decision-making expands as AI trustworthiness increases over time. Bots handle larger transaction amounts without human approval requirements. Exception handling improves as systems learn from edge cases. Human oversight focuses on truly unusual situations requiring judgment.

Blockchain Integration Opportunities

Smart contracts automate complex transaction conditions and multi-party agreements. Trigger conditions execute payments automatically when fulfilled completely. Escrow arrangements protect both buyers and sellers in transactions. Dispute resolution mechanisms handle conflicts according to predefined rules.

Cryptocurrency payment options expand as digital currencies gain mainstream adoption. Bot interfaces make crypto payments as easy as traditional methods. Automatic conversion to local currency eliminates volatility concerns. Lower transaction fees benefit both businesses and customers financially.

Supply chain transparency improves with blockchain-tracked transaction data immutably. Product provenance verification confirms authenticity for high-value goods. Counterfeit prevention protects brand reputation and customer safety. Regulatory compliance documentation travels with products automatically throughout chains.

When integrating SaaS AI transaction bots for businesses with blockchain, security strengthens significantly. Distributed ledgers eliminate single points of failure vulnerabilities. Immutable records prevent transaction history tampering or fraud. Cryptographic verification ensures transaction integrity without trusted intermediaries.

Voice and Visual Commerce

Voice-first transactions enable hands-free purchasing through smart speakers. Customers shop while cooking, driving, or otherwise occupied physically. Voice authentication provides security without typing passwords. Natural conversation makes complex transactions accessible to everyone.

Visual search capabilities let customers find products by photographing them. AI identifies items from images and presents purchase options. Augmented reality previews show products in customer environments. Virtual try-on technology reduces returns for apparel and accessories.

Video commerce combines live streaming with instant purchasing capabilities. Influencer content includes embedded buy buttons for featured products. Live shopping events create urgency through limited-time offers. Interactive features let viewers ask questions during broadcast sessions.

Read More: Best AI Call Escalation Solutions for Growing Businesses

Conclusion

Business transactions form the lifeblood of every commercial enterprise daily. Traditional manual processes create unnecessary friction and expense. Errors and delays frustrate customers and hurt revenue performance. Your organization deserves better tools for this critical function.

SaaS AI transaction bots for businesses transform how companies handle sales. Automation eliminates repetitive tasks that waste valuable staff time. Accuracy improvements reduce costly errors and correction efforts. Customer satisfaction increases with faster, smoother transaction experiences provided.

The investment in SaaS AI transaction bots for businesses pays returns quickly. Labor cost savings alone often justify expenses within months. Revenue improvements from better conversion rates add additional value. Competitive advantages come from superior customer experiences delivered consistently.

Your customers expect increasingly seamless transaction experiences across all channels. Companies that automate effectively will thrive in coming years. Those clinging to manual processes will struggle against automated competitors. The choice to modernize transaction handling is straightforward and urgent.

SaaS AI transaction bots for businesses represent the future of commerce. Every organization will automate transactions eventually as technology improves. The question is whether you lead or follow this transformation. Choose to lead by implementing these powerful tools now.

Success requires commitment from leadership and engagement from teams. Allocate adequate resources for proper implementation and support. Communicate benefits clearly to build enthusiasm for change. Celebrate achievements along the journey to maintain momentum forward.